Benefits of Trade

- Published Sep 20, 2023

Benefits of trade on NavExM over other contemporary exchanges.

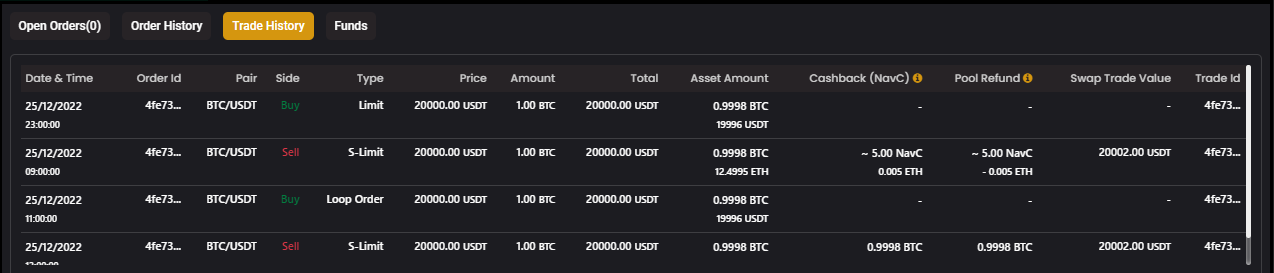

Low Impact Cost - When it comes to trading on exchanges, the impact of cost is an important factor that traders need to consider. Impact cost refers to the cost incurred when executing an order, which includes SWAP Fees and any other charges levied by the platform. These costs can eat into a trader's profits, making it important to minimize impact cost as much as possible.

One platform that can help reduce impact cost is NavExM. NavExM is an exchange that offers zero-SWAP Fees, meaning that traders can execute their orders without incurring any transaction costs. This can be a huge advantage for traders who are looking to maximize their profits, as they can keep more of their earnings and reinvest them into other trades.

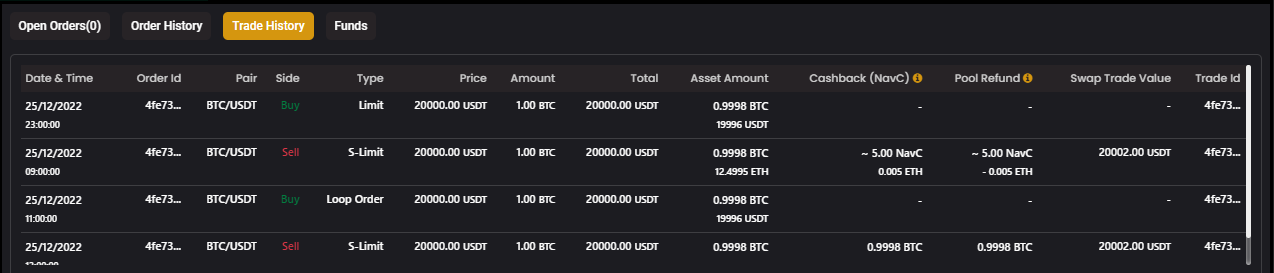

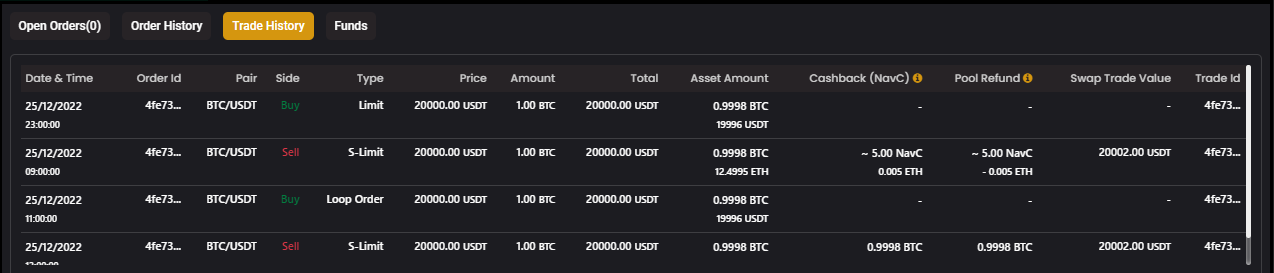

In addition to offering zero-SWAP Fees, NavExM also provides cashback benefits to traders. This means that traders earn on every trade they make, regardless of whether they make a profit or a loss. This can be a significant advantage for traders, as it can help offset any losses they may incur and make it easier to stay profitable over the long term.

Overall, NavExM is an excellent platform for traders who are looking to reduce their impact cost and maximize their profits. With zero-SWAP Fees and cashback benefits, traders can execute their orders with confidence, knowing that they are keeping more of their earnings and earnings on every trade they make.

Higher Risk Tolerance to Profit ratio - NavExM's native utility token, NavC, has a unique value proposition that sets it apart from other tokens in the market. NavC is a value variance inflationary token, which means that its supply increases with every transaction, ensuring a steady increase in value over time.

The utility of NavC makes it a low-risk, high-yield asset. NavC tokens are offered in cashback, which acts as a defense mechanism in adverse market conditions. Cashback rewards help users mitigate losses during market downturns and provide them with a passive income stream.

One of the key benefits of holding NavC tokens is the increased risk tolerance to profit ratio. With the utility of NavC, users can enjoy higher yields with relatively lower risk. This means that investors can make higher profits without having to take on excessive risk.

NavC's value variance inflationary model and its utility make it a highly attractive investment option for those looking for a safe and profitable investment option. The token's price appreciation is expected to continue as more users start adopting it for its unique features and benefits.

In summary, NavExM's native utility token, NavC, offers a unique value proposition that combines low risk with high yields. With its cashback rewards and value variance inflationary model, NavC tokens act as a defense mechanism in adverse market conditions and provide investors with a high-risk tolerance to profit ratio. As such, NavC is a valuable asset for investors looking to make a safe and profitable investment.

Liquidity pool - In the world of digital assets trading, liquidity is the key to success. The availability of a deep and active liquidity pool can make or break the trading experience for many traders. This is where the concept of liquidity pools comes in. A liquidity pool is a pool of tokens that are locked into a smart contract, which allows traders to exchange these tokens without the need for an intermediary.

NavExM is a next-generation exchange that offers an augmented liquidity pool to its users. This means that traders on NavExM can access a much larger liquidity pool than what is typically available on other exchanges. This larger liquidity pool is made possible by a combination of factors, including the NavExM cashback benefits.

The NavExM cashback benefits enable traders to liquidate even their illiquid assets at a limited trade loss. This is a game-changer for traders who may be holding onto digital assets that are not very liquid. In the past, these assets would be difficult to sell without taking a significant loss. But with NavExM's cashback benefits, traders can now liquidate these assets at a limited trade loss and still come out ahead.

The cashback benefits offered by NavExM also make trading revenue positive for traders. This means that traders can actually make money on their trades, even after taking into account any trade losses they may incur. This is a significant benefit that sets NavExM apart from other exchanges, as it incentivizes traders to trade more actively and more frequently.

All of these benefits lead to surged trade volume for even illiquid digital assets on the exchange, creating an extensive liquidity pool resulting in faster trade settlement. This is because a larger pool of tokens means that trades can be settled more quickly, as there are more buyers and sellers available to match orders.

In summary, NavExM's augmented liquidity pool and cashback benefits make it a Next-Generation exchange that offers traders a significant advantage over other exchanges. By providing traders with a larger liquidity pool, cashback benefits, and revenue-positive trading, NavExM is creating a more active and vibrant trading environment for digital assets, which is beneficial for traders and the broader digital assets ecosystem.

Market Making - NavExM is a crypto exchange that offers market making services to its clients. As a market maker, NavExM provides liquidity to buyers and sellers by simultaneously offering to buy and sell various cryptocurrencies at a publicly quoted price. By doing so, NavExM helps ensure that its clients can easily trade cryptocurrencies without experiencing significant price fluctuations or delays in execution.

NavExM uses advanced technology and algorithms to adjust its prices in real-time based on market conditions, news, and other factors that may impact the demand and supply of cryptocurrencies. Additionally, NavExM employs a sophisticated risk management system to manage its exposure to market risk and ensure the stability of its operations.

By offering market making services, NavExM helps foster a more efficient and liquid cryptocurrency market. Its clients can benefit from faster and more reliable trades, as well as reduced market volatility. At the same time, NavExM earns a profit by charging a spread on its buy and sell orders, which compensates it for the risk it takes by offering liquidity to the market.

What is Crypto Trading?

- Published Sep 29, 2023

Cryptocurrency trading involves buying and selling cryptocurrencies on an exchange. At our platform, you can trade cryptocurrencies by speculating on their price movements via CFDs (contracts for difference). CFDs are leveraged derivatives, which means you can trade cryptocurrency price movements without taking ownership of any underlying coins.

When trading derivatives, you can go long ('buy') if you think a cryptocurrency will rise in value or go short ('sell') if you think it will fall. By contrast, when you buy cryptocurrencies on an exchange, you buy the coins themselves. This requires you to create an exchange account, put up the full value of the asset to open a position, and store the cryptocurrency tokens in your own wallet until you're ready to sell.

Cryptocurrencies are notoriously volatile, and for traders using leveraged derivatives that allow for both long and short positions, large and sudden price movements present opportunities for profit. However, at the same time, these movements also increase your exposure to risk. In short, the more volatile the market, the more risk you carry when trading it.

When trading cryptocurrencies with us, you can access real-time pricing. We derive our prices from several exchanges, and they're calculated on a continuous basis. Our prices are reflective of the underlying market, and because they are based on real markets in real time, they always reflect actual market sentiment. You can enter and exit positions quickly owing to tight spreads and our fast execution. We also provide a secure platform that you can utilise measures such as the two-factor authentication (2FA) to ensure you're secure when trading online.

In summary, trading cryptocurrencies with us via CFDs allows you to take advantage of the price movements of cryptocurrencies without the need to own the underlying assets. With our platform, you can access real-time pricing, enter and exit positions quickly, and trade on a secure platform. However, it's essential to note that trading cryptocurrencies carry risks, and you should always ensure you understand the risks involved before you start trading.

What Is Trading ?

- Published Oct 08, 2023

Cryptocurrency trading is the buying and selling of cryptocurrencies on an exchange. With our platform, you can trade cryptocurrencies by speculating on their price movements via CFDs (contracts for difference). CFDs are leveraged derivatives, which means you can trade cryptocurrency price movements without taking ownership of any underlying coins.

When trading derivatives, you can go long ('buy') if you think a cryptocurrency will rise in value or go short ('sell') if you think it will fall. By contrast, when you buy cryptocurrencies on an exchange, you buy the coins themselves. This requires you to create an exchange account, put up the full value of the asset to open a position, and store the cryptocurrency tokens in your own wallet until you're ready to sell.

Cryptocurrencies are notoriously volatile, and for traders using leveraged derivatives that allow for both long and short positions, large and sudden price movements present opportunities for profit. However, at the same time, these movements also increase your exposure to risk. In short, the more volatile the market, the more risk you carry when trading it.

When trading cryptocurrencies with us, you can access real-time pricing. We derive our prices from several exchanges, and they're calculated on a continuous basis. Our prices are reflective of the underlying market, and because they are based on real markets in real time, they always reflect actual market sentiment. You can enter and exit positions quickly owing to tight spreads and our fast execution. We also provide a secure platform that you can utilize measures such as the two-factor authentication (2FA) to ensure you're secure when trading online.

In summary, trading cryptocurrencies with us via CFDs allows you to take advantage of the price movements of cryptocurrencies without the need to own the underlying assets. With our platform, you can access real-time pricing, enter and exit positions quickly, and trade on a secure platform. However, it's essential to note that trading cryptocurrencies carries risks, and you should always ensure you understand the risks involved before you start trading.

Trading View / Trader Workstation:

- Published Oct 12, 2023

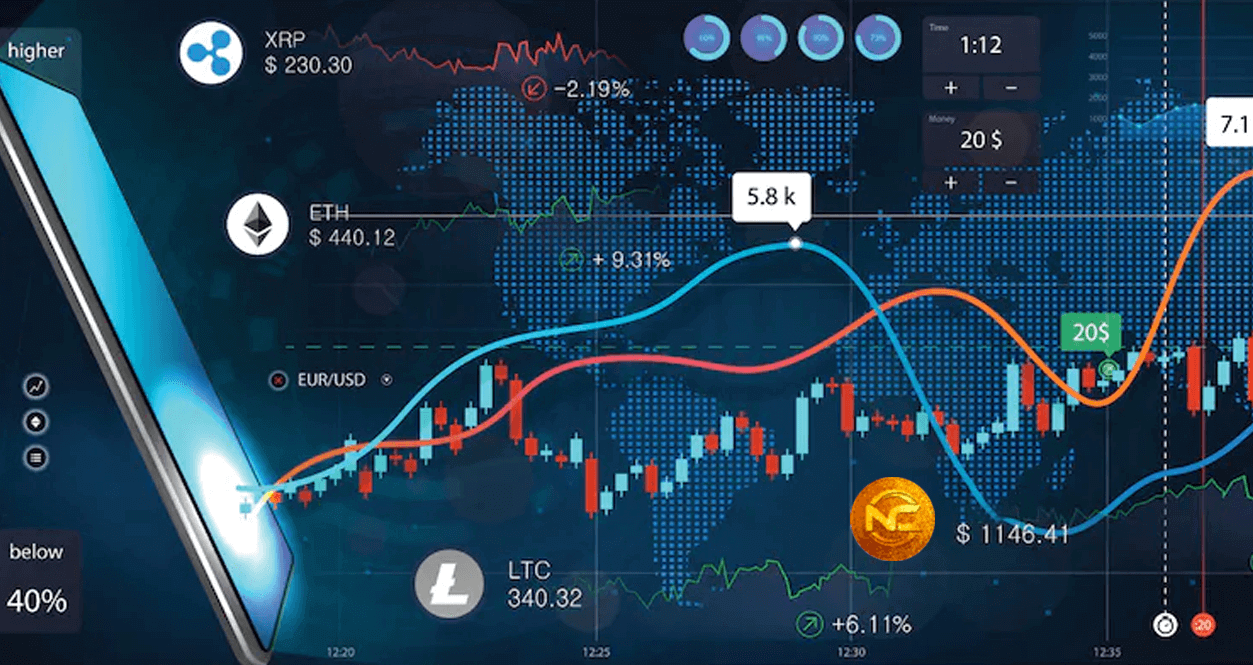

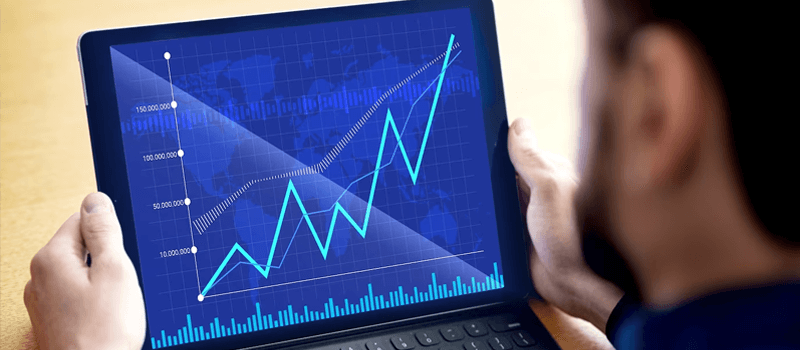

TradingView is a popular and widely used platform for traders to visualize and analyze financial markets. It offers an interactive view for users, including graphical representations of historical and real-time price and volume action, and the option to set different parameters to customize the graph. Additionally, TradingView displays active and passive live orders in the market, which helps users understand market depth.

Traders can use TradingView to place orders according to their preference, and view their real-time Notional or Booked P/L. The platform also offers a range of charting tools and technical indicators to help traders make informed decisions about the markets.

With TradingView, users can easily keep track of their portfolio value, monitor their trading performance, and implement buy and sell decisions based on the insights they gain from the platform. The platform is accessible on desktop and mobile devices, making it a convenient tool for traders on-the-go.

In summary, TradingView is an essential tool for traders looking to stay up-to-date with the latest market trends and make informed decisions about their trading strategies. Its intuitive interface, robust charting tools, and real-time market data make it a go-to platform for traders of all levels.

Spot Trading

- Published Oct 13, 2023

In a spot market, traders can immediately exchange their cryptocurrency for fiat currency or another cryptocurrency by placing a buy or sell order.

The base market, where crypto assets are instantaneously exchanged and settled, is known as a spot market, and trading in this market includes buying digital currencies like Bitcoin or other altcoins and holding them until their value rises.

It is called spot trading because the transactions are settled “on the spot.” Furthermore, spot markets include sellers, buyers and order books. Sellers make an order with a specific ask or sell price, and buyers place an order for any cryptocurrency token with a particular bid or purchase price. The bid price is the highest price that a buyer is ready to pay, and the ask price is the lowest price that a seller is willing to accept as payment.

The order book has two sides: The ask side for buyers eager to buy and the bid side for sellers willing to sell. The order book records bids and asks in the order book. For instance, in spot trading, if Bob makes an order to purchase BTC, this transaction will instantly go to the bid side of the order book. When a seller from the crypto spot trading platform is selling at the same specifications, this order is automatically filled.

The transaction continues to the ask side of the order book when Bob enters an order to sell BTC in the above crypto spot trading example. The orders in green in the order book reflect purchasers of a specific token, while the orders in red represent sellers of that token

The goal of spot trading is to buy low and sell high in order to make a profit, but it's not sure that this tactic will always work to the traders’ advantage considering the volatility of the crypto market.

The spot price, trade date and settlement date are the three crucial concepts in spot trading. The current price of any asset is called the spot price, and the traders can sell assets under consideration immediately at this price. Additionally, one can buy or sell cryptocurrencies with other users on various exchange platforms.

The spot price changes as new orders are placed and old ones are filled. The trade date initiates and records the transaction and represents the day the market actually carries out the trade. The assets involved in the transaction are actually transferred on the settlement date, also known as the spot date.

Depending on the sort of market being traded, there may be one day or several days between the trade date and the settlement date. For cryptocurrency, it usually happens on the same day, though it may differ among exchanges or trading platforms.

Pros and cons of crypto spot trading

When you purchase an asset at the spot price, one truly becomes the asset owner, allowing traders to sell it or relocate it to offline storage as they like. In addition, spot trading enables traders to use their cryptocurrency assets for additional functions like online payments or staking.

Moreover, spot trading is substantially less risky than margin trading, i.e., one can invest in crypto assets without worrying about losing money due to price changes and dealing with margin calls. As a result, the trader does not run the risk of contributing more of their own money or losing more money than they already have in their account because there are no margin calls.

However, the biggest drawback of spot trading is that it does not offer the advantage of any potential return amplification that leverage in margin trading might provide. Moreover, due to the absence of leverage, potential gains in the spot market are lower than those in margin trading.

Trade Attributes

- Published Oct 14, 2023

Transaction Hash, Method, Block, Age, From, To, Value, swap fees

- Transaction Hash: A transaction hash or ID is a unique string of characters that is given to every transaction that is verified and added to the blockchain. This hash is used to identify a transaction and can be used to locate funds. For example, in transaction hash

"0xb3be368b28911b12c6f03e970b2a7f76b99b337c6e4c91c7cfbebae47f6ce5e8", the following details are visible on Etherscan. - Method: The method field defines the transaction type, such as "Transfer," "Withdraw," "Pay," "Approve," "Multisign," "Multicall," "Deposit," "Deposit Native," "Remove Liquidity," etc. It provides information about the purpose of the transaction.

- Block: The block field shows the block number in which the transaction hash details have been recorded. Blocks are added to the blockchain in chronological order, and each block contains a certain number of transactions.

- Age : The age field defines the time difference from the current timestamp at which the transaction happened. This is useful in determining how long ago a transaction occurred.

- From: The from field defines the seller wallet address from which the transaction was initiated.

- To: The to field defines the buyer wallet address to which the transaction was sent.

- Value: The value field defines the value of the transaction in terms of the native token of that ecosystem. For example, if the transaction is on the Ethereum blockchain, the value field will be in Ether.

- swap fees: The swap fees is the cost levied on the transaction for the miners to process it. This fee is paid in the native token of the ecosystem, and it varies depending on the blockchain's congestion. The fee can be adjusted depending on how quickly you want the transaction to be processed.

Understanding these transaction details is essential for tracking and managing your transactions on the blockchain. It is important to note that these details may vary depending on the blockchain and the type of transaction being made.

Technical Analysis

- Published Oct 16, 2023

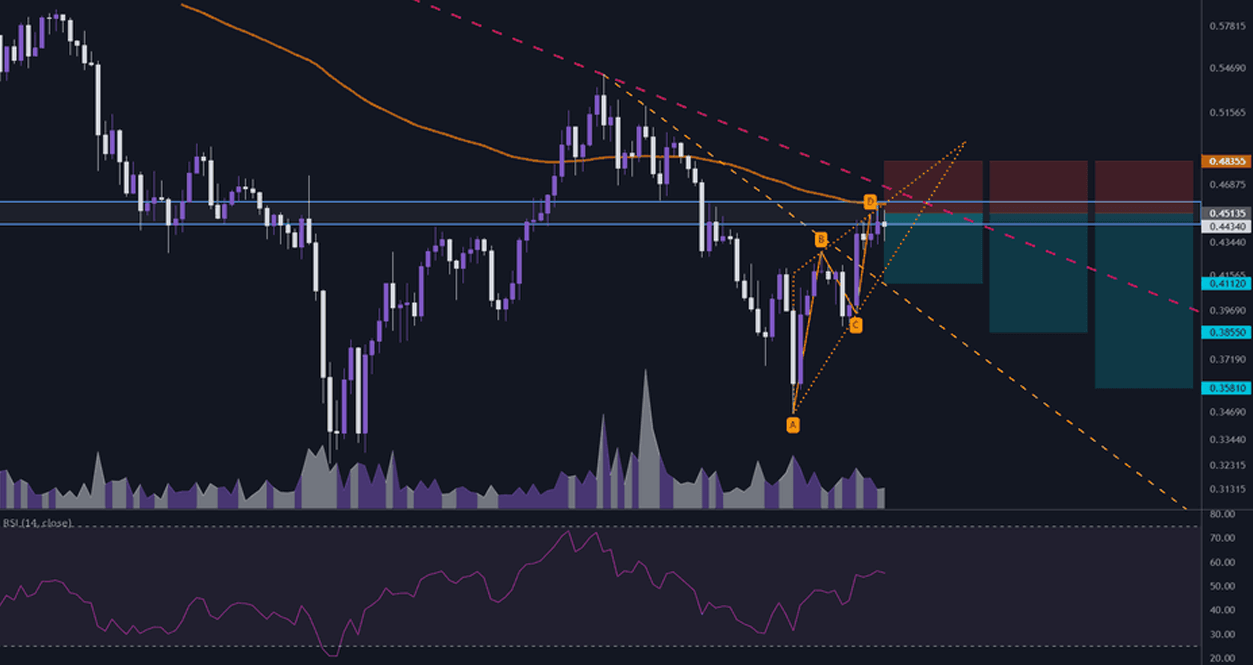

Technical analysis is a method used to analyze and predict the future prices of securities, including cryptocurrencies. Technical analysts rely on historical price and volume data, charts, trends, and other factors to identify potential buying and selling opportunities. Technical analysis is based on the assumption that past price movements can help predict future price movements.

There are several different types of charts used in technical analysis, including:

- Candlestick charts: These charts display price movements over a certain period of time using candlesticks, which represent the open, high, low, and close prices.

- Line charts: These charts display the closing prices of an asset over a certain period of time using a continuous line.

- Bar charts: These charts display price movements over a certain period of time using vertical bars that represent the open, high, low, and close prices.

- Area charts: These charts display the price movements of an asset over a certain period of time using a filled area under a line chart.

Candle Stick Chart

- Published Oct 21, 2023

A candlestick chart is a type of financial chart that graphically represents the price moves of an asset for a given timeframe. As the name suggests, it’s made up of candlesticks, each representing the same amount of time. The candlesticks can represent virtually any period, from seconds to years.

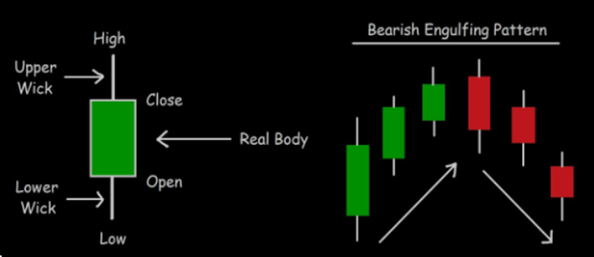

A single candle contains four pieces of information:

- Open (O) - the price at which the asset opened during the given timeframe

- High (H) - the highest price of the asset during the given timeframe

- Low (L) - the lowest price of the asset during the given timeframe

- Close (C) - the price at which the asset closed during the given timeframe

In addition to these four pieces of information, color is the fifth piece of information that comes into play. The color of the candle indicates whether the asset's price is rising or falling. The default setting is a white background, where green candles (with black borders to make them visible against a white background) are up candles, indicating that the asset's price has risen during the given timeframe. In contrast, red candles are down candles, indicating that the asset's price has fallen during the given timeframe.

Below is a diagram of a typical candlestick chart

Candlestick Chart Patterns - Basic Introduction - Price Action Trading Strategies

Body and wick

In candlestick charts, the body of the candle represents the difference between the opening and closing prices for the given time period. The top and bottom of the body indicate the opening and closing prices respectively. When the closing price is higher than the opening price, the candle is typically colored green, indicating a bullish trend. Conversely, when the closing price is lower than the opening price, the candle is usually colored red, indicating a bearish trend.

The wick or shadow of the candlestick represents the highest and lowest price for the given time period. The upper wick represents the highest price reached during that period, while the lower wick represents the lowest price. The length of the wick indicates the range of price movement and the volatility of the market during that time period.

Traders often use candlestick charts to identify specific formations, such as the doji, hammer, and shooting star patterns, which can indicate potential changes in trend direction. By analyzing candlestick patterns, traders can make informed decisions about when to enter or exit trades.

Order

- Published Oct 22, 2023

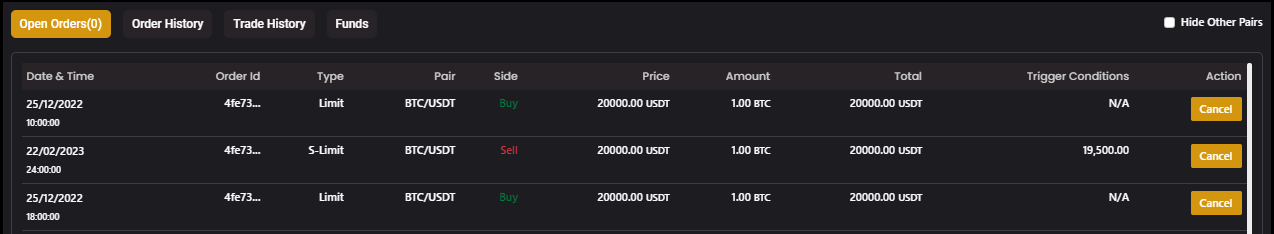

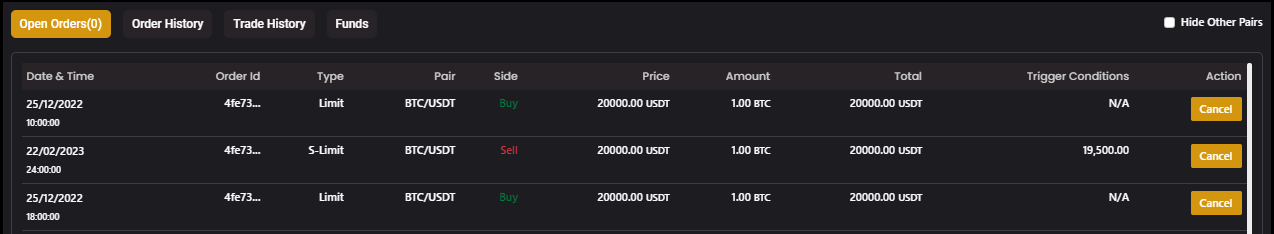

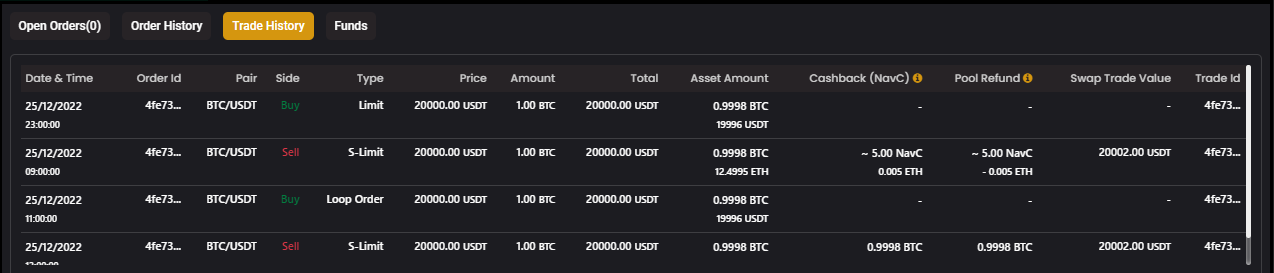

Understanding Your Orders

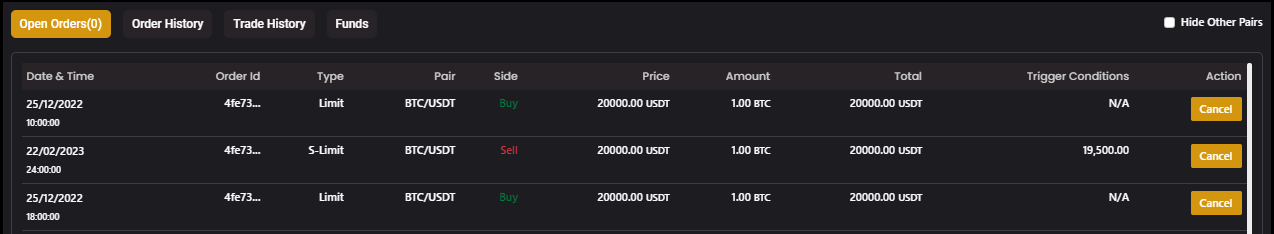

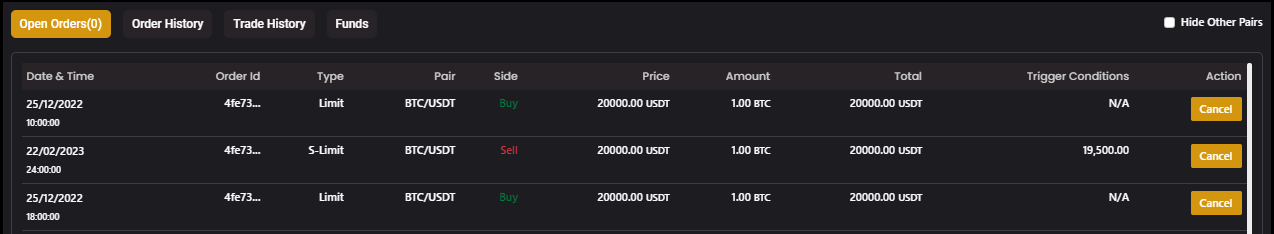

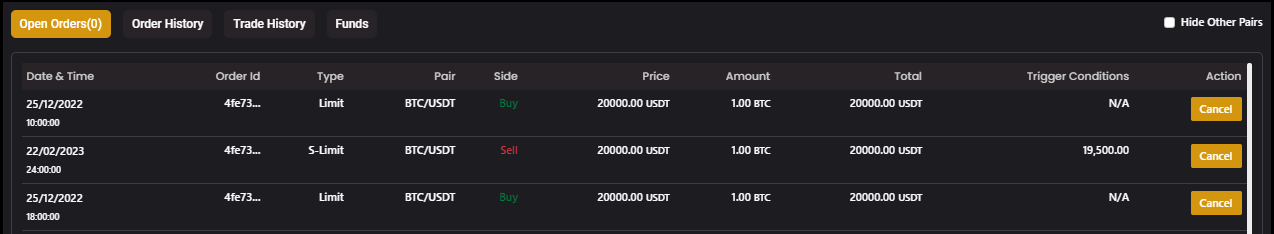

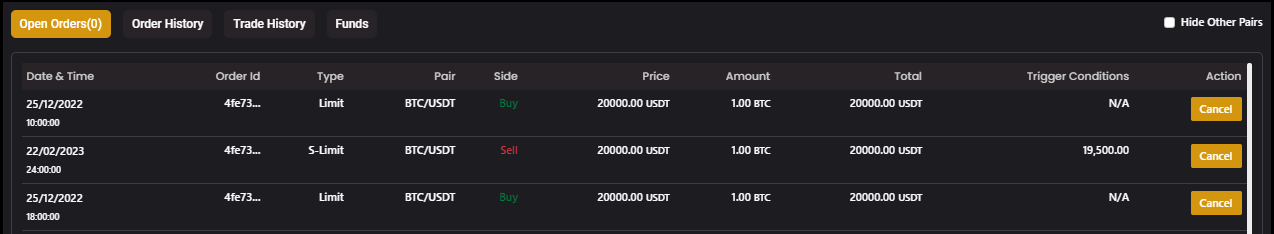

When trading in the cryptocurrency market, it is important to have a good understanding of the various types of orders you can place and the information associated with them. In this article, we will take a closer look at some of the common order types and the information you can expect to see in your order history and trade history.

Spot Order: A spot order is a type of order that is executed immediately at the current market price. It is commonly used in trading and investing to buy or sell an asset on the spot market. The spot market is where financial instruments, such as stocks, currencies, and commodities, are traded for immediate delivery or settlement.

When you place a spot order, you specify the amount of the asset you want to trade, and whether you want to buy or sell it. The order is then executed immediately, based on the prevailing market price. This means that the trade is settled instantly, and the asset is transferred from the seller to the buyer.

Spot orders are commonly used in daily trading or short-term trading strategies, where the trader is looking to take advantage of short-term price movements in the market. They are also used by investors who want to buy or sell an asset quickly, without having to wait for a specific price or market condition.

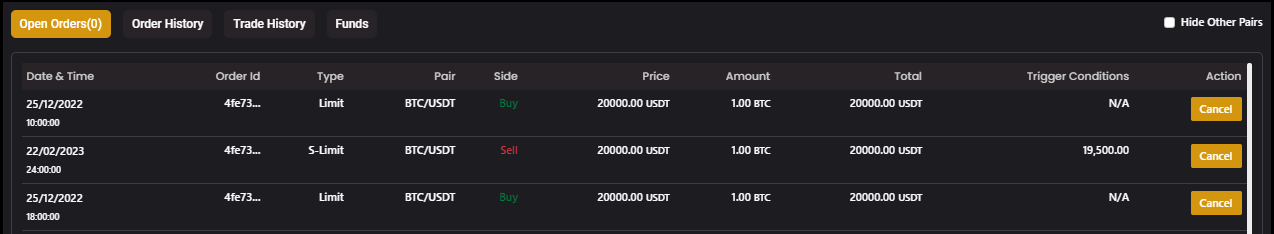

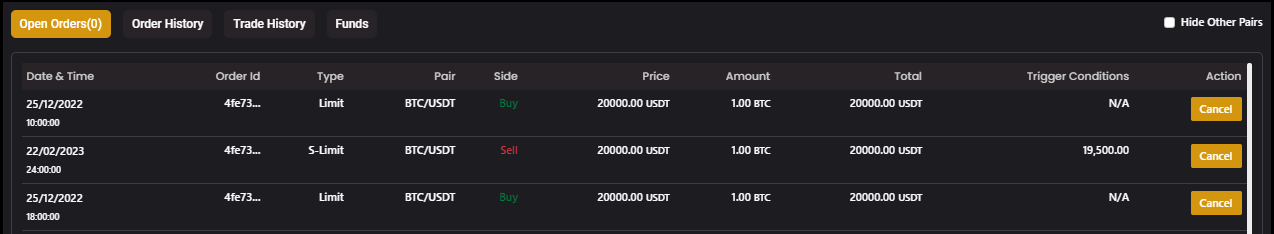

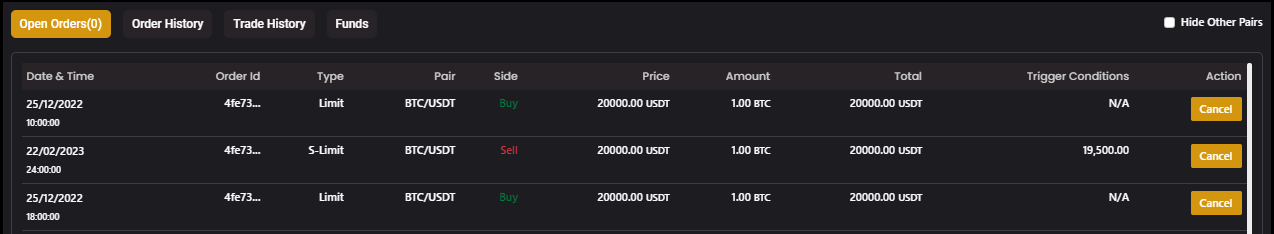

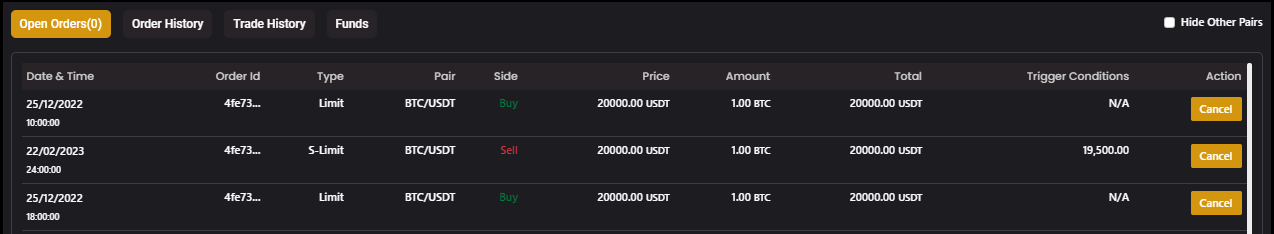

Open Order: An open order is an order that has been placed on the market but has not yet been executed. When a trader places an open order, it is added to the order book and remains there until it is matched with a counter order that satisfies its conditions or until it is cancelled by the trader.

Open orders are usually used to set a target price at which the trader wants to buy or sell an asset in the future.

For example, if a trader wants to buy a certain cryptocurrency when its price drops to a certain level, they can place an open order with that specific price level. Once the price of the asset reaches that level, the open order will be executed automatically. Until that happens, the open order will remain in the order book waiting to be filled by a matching order.

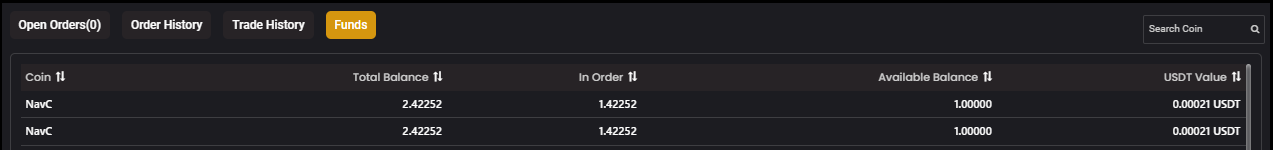

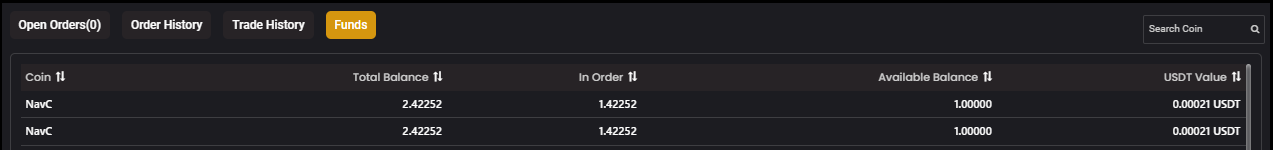

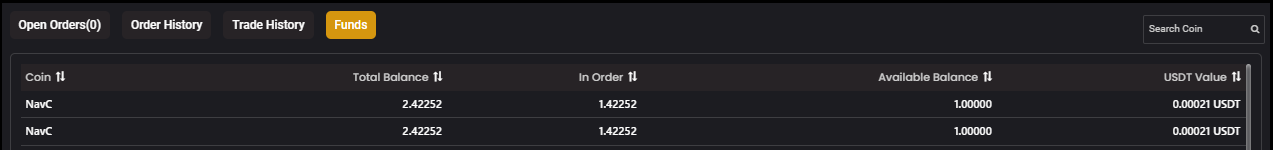

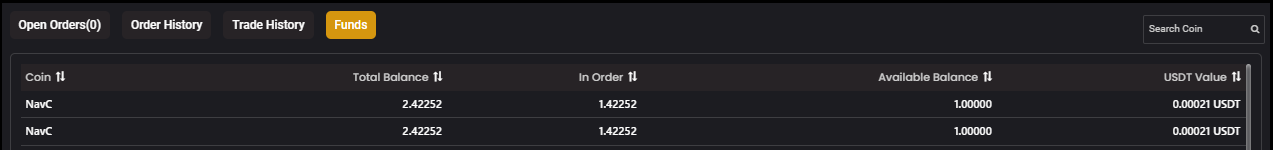

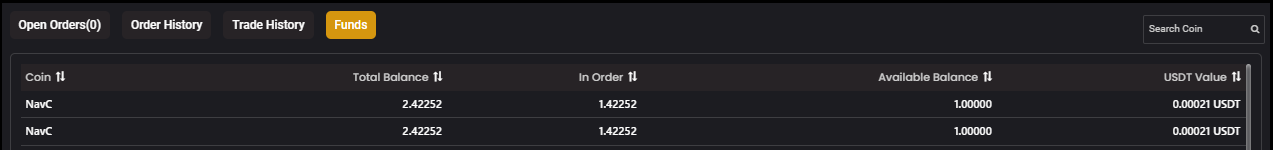

Order History: Order history is a record of all the orders that have been placed, modified, cancelled, or executed on an exchange. The order history section typically displays a list of all the orders a trader has placed and their current status. This information is important for traders to keep track of their trading activity and to analyze their performance over time.

The order history section typically includes details such as the order ID, timestamp, order type (buy or sell), order status (open, filled, cancelled), and other relevant information such as the amount and price at which the order was placed. Traders can use this information to track the progress of their orders, to see which orders have been filled, which have been cancelled, and to analyze their trading behavior.

Order history can be useful for traders in many ways. For example, it can help traders to identify patterns in their trading behavior, to see which types of orders are most successful, and to analyze the effectiveness of their trading strategies. Additionally, order history can be used to track the performance of individual trades, to see how much profit or loss was made on each trade, and to identify areas where improvements can be made.

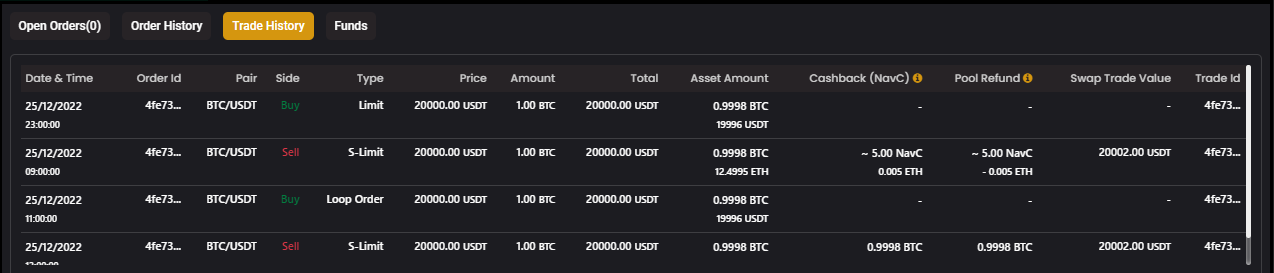

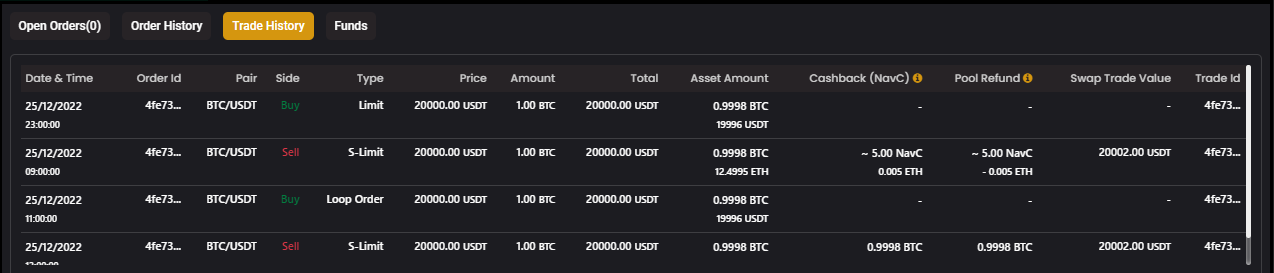

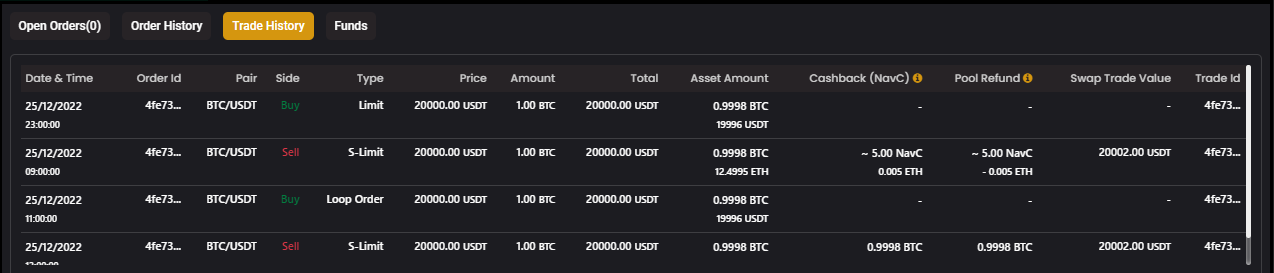

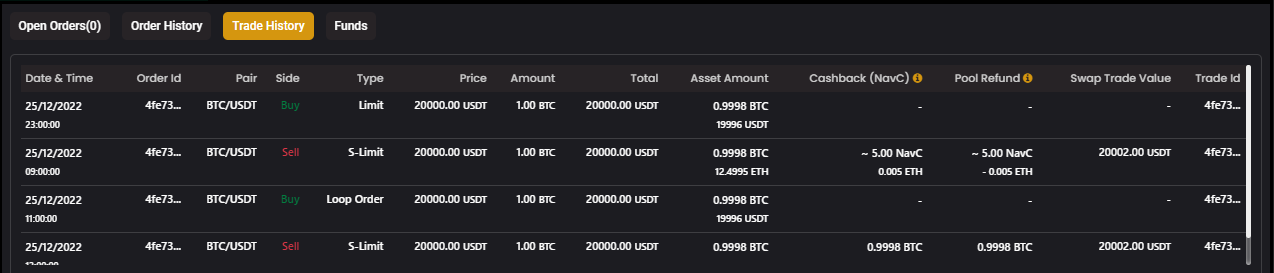

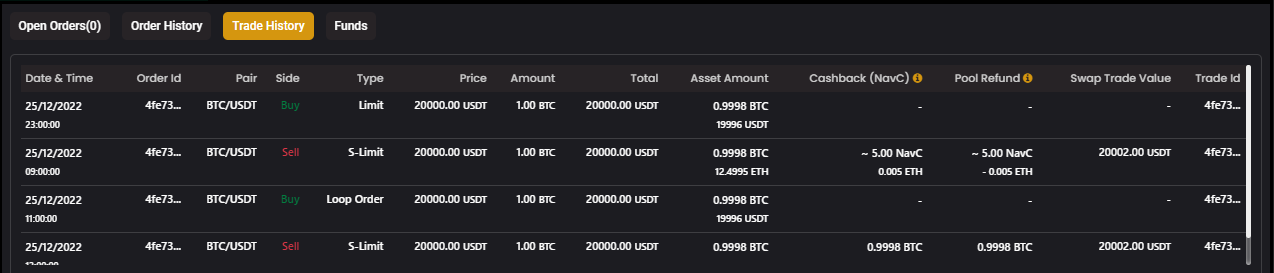

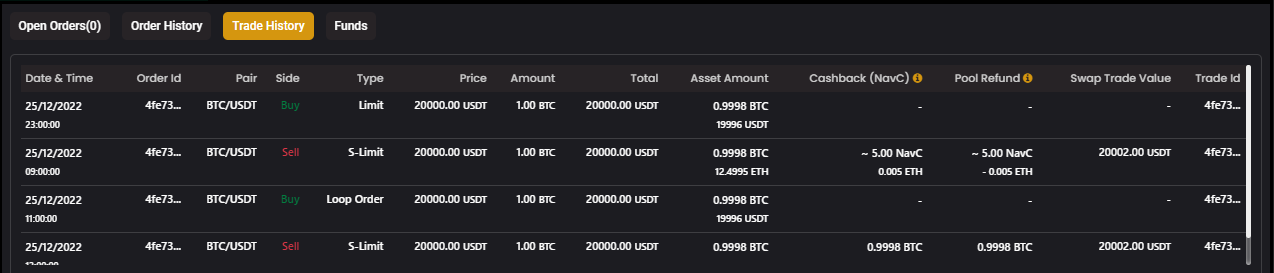

Trade History : Trade history is a section that displays all the executed trades that a user has made in the past. It includes details such as the unique trade ID, timestamp, order type, amount, price, and fee associated with each trade. It provides a complete record of all the transactions made by the user and can be useful for keeping track of profits and losses. The trade history section can also provide insights into a user's trading behavior, allowing them to identify patterns and improve their trading strategy.

Conclusion

Understanding your orders is crucial when trading in the cryptocurrency market. By knowing the different types of orders you can place, and the information associated with them, you can make informed decisions and manage your trades more effectively. Be sure to check your order history and trade history regularly to keep track of your trades and monitor your progress.

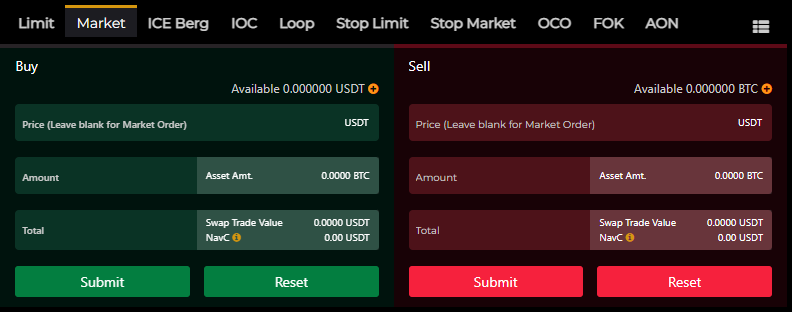

Market Order

- Published Oct 16, 2023

Traders mostly use Market orders where they want to trade on immediate basis without the limitation of desired price. If trader think that the current market price will quickly move against their favorable price, i.e., if they think price will move up anytime, and user wants to buy it irrespective of price limit, he will likely place Market Buy Order; if they think price will move down anytime, and user wants to sell it irrespective of price limit, he will likely place Market Sell Order. During extreme volatile market users place these orders.

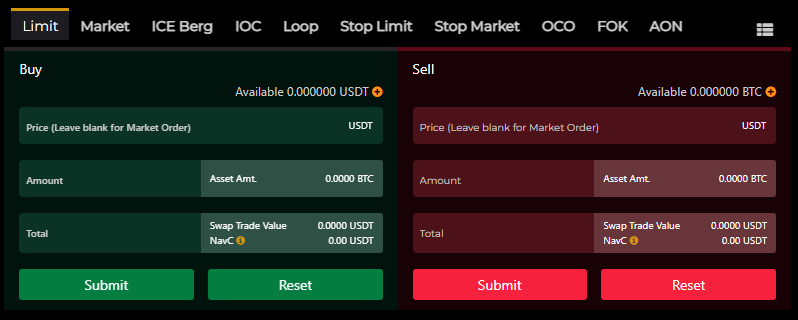

On the selection of Market Order section, option to put Price will be disabled. Trader needs to specify the desired amount or desired Value of such Market order, which will be filled according to the traded price. Execution is almost assured on immediate basis subject to the availability of the counter party.

Traders need to open their desired trading pair available in NavExM. On the selection of Market Order, option to put Price will be in a disabled status and Amount(quantity) and Total will be available. Trader has to specify any of them to place the market order.

To successfully place a Market Order, one need to have the currency in their wallet, against which the other asset will execute. Let’s assume the Trading Pair is BTC/USDT. For Buy orders USDT need to be available to Buy BTC; and for Sell orders BTC need to be available to get USDT. The value of such order should be within the available limit.

If the order value is more than the available limit balance, it will show trader to add/deposit that asset with amount to fulfil the transaction.

User with Market Order will be considered as "Taker" and cashback benefit will be considered according to it.

Post Order

- If user have placed a market order, it will execute on immediate basis with the prevailing counter party rates in the market while placing such order.

- If there is no counterparty present to trade, it will not match, it will show in “Open Orders” @lowest tick rate for Sell Order and at highest Cap Price for Buy Order.

- Once the market order gets executed, it will show in “Trade History” as well as in “My Trades”.

- After placing market order the trade will settle as per best counter party price availability.

a) For e.g.: If trader "A" placed a Market Buy Order in BTC/USDT of $1,000 value and there were best sellers of BTC/USDT were as of:

| Price | Amount | Total |

|---|---|---|

| $ 20,050.00 | 0.004988 | $ 100.00 |

| $ 20,110.00 | 0.009945 | $ 200.00 |

| $ 20,150.00 | 0.024814 | $ 500.00 |

| $ 20,200.00 | 0.019802 | $ 400.00 |

Here trade will settle up to $1,000 i.e., last trade will be of $200 @$20,200 and the amount will be $200/$20200=0.009901.

The total Amount of BTC bought will be 0.004988+0.009945+0.024814+0.009901= 0.049648.

Therefore, the average traded price will be $1000/0.049648=$20,141.92.

b) If trader "A" placed a Market Buy Order in BTC/USDT of 0.050000 BTC amount and the best sellers of BTC/USDT were as above:

Here trade will settle up to 0.050000 i.e., last trade will be of 0.010253 BTC @$20,200 and the value will be $20200*0.010253 =$207.12.

The total value of BTC bought will be $100+$200+$500+$207.12 = $1,007.12.

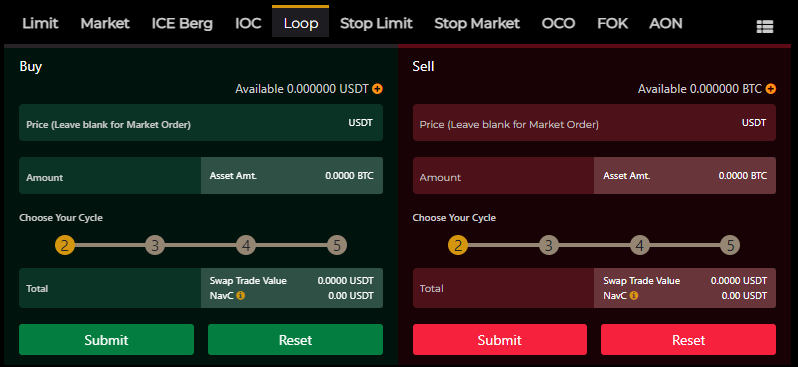

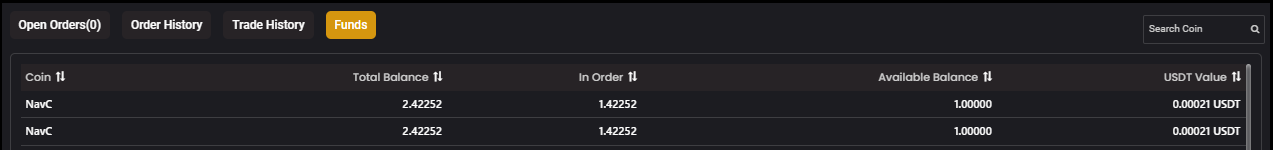

Loop Order

- Published Oct 06, 2023

It is a new kind of order introduced by NavExM. Traders can use Loop orders to enhance their cashback benefit, as with loop order NavExM assures the trader to complete the defined trading cycle by giving credit of cashback to the user. Trades can happen only when the market price matches with defined price. With partial execution also traders can get the benefit of loop order.

Traders need to open their desired trading pair available in NavExM. On the selection of Loop Order, option to put Price, Amount(quantity), Loop Cycle and Total will be available. User can specify order price, Loop cycle and any one of Amount or Total Value, it will autofill simultaneously.

To successfully place a Loop Order, one need to have the currency in their wallet, against which the other asset will execute. Let’s assume the Trading Pair is BTC/USDT. For Buy orders USDT need to be available to Buy BTC; and for Sell orders BTC need to be available to get USDT. The value of a single loop cycle should be within the available limit.

If the order value of a single loop cycle is more than the available limit balance, it will show trader to add/deposit that asset with amount to fulfil the transaction.

If user have placed a loop order, the total order value of a single cycle will be reduced from the available balance even if same is yet to execute.

For Buy orders user have to place limit Buy price <= current market price, otherwise it will trade as market order; and for Sell orders user have to place limit Sell price >= current market price, otherwise it will trade as market order.

User with Limit Order will be considered as "Maker" and cashback benefit will be considered according to it.

Post Order

- If the loop order doesn’t match, it will show in “Open Orders”.

- Once the limit price matches with market price, it will get executed.

- On partial execution user will get the cashback benefit as per executed amount * cycle no.

- Once the limit order gets executed completely, it will not show in open orders, it will show in “Trade History” as well as in “My Trades”.

- On partial execution, the executed portion will show in trades and remaining will show in open orders.

- Execution of all orders are based on price-time-priority.

For e.g.: If trader "A" placed a Loop Buy Order in BTC/USDT @ $20,050 with 5 cycle of $1,000 value and the best sellers of BTC/USDT available in the market are as follows:

| Price | Amount | Total |

|---|---|---|

| $ 20,050.00 | 0.004988 | $ 100.00 |

| $ 20,110.00 | 0.009945 | $ 200.00 |

| $ 20,150.00 | 0.024814 | $ 500.00 |

| $ 20,200.00 | 0.019802 | $ 400.00 |

Here trade will settle up to $500, i.e., $100 * 5.

The total Amount of BTC bought will be 0.004988.

Applicable cashback will be on $500.

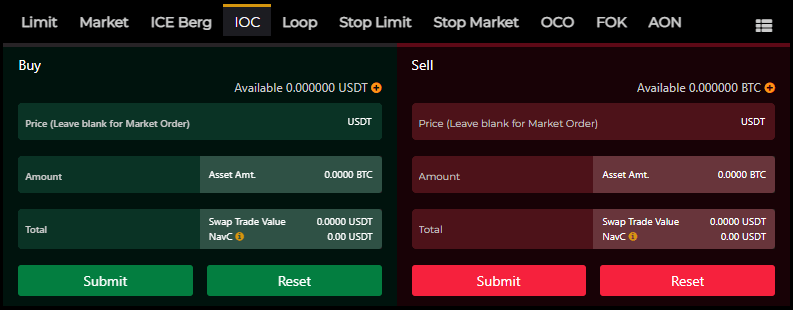

IOC (Immediate or Cancel) Order:

- Published Sep 01, 2023

Traders mostly use IOC orders where they want to trade only while placing the order at their desired price with specific amount, if the desired price matches after a while of placing order, it should not execute. Trades can happen only when the market price matches with defined price at the time when the order is placed.

On the selection of IOC Order, option to put Price, Amount(quantity) and Total will be available. User can specify order price and any one of Amount or Total Value, the third value will autofill simultaneously.

To successfully place an IOC Order, one need to have the currency in their wallet, against which the other asset will execute. Let’s assume the Trading Pair is BTC/USDT. For Buy orders USDT need to be available to Buy BTC; and for Sell orders BTC need to be available to get USDT. The value of such order should be within the available limit.

If the order value is more than the available limit balance, it will show trader to add/deposit that asset with amount to fulfil the transaction.

If user have placed an IOC order, it will either execute, or will get cancelled. The executed order value will be reduced from the available balance (USDT) and will convert into another asset in which traded (BTC).

To trade with IOC order, for Buy orders user have to place IOC Buy price >= current market price, otherwise it will get cancelled; and for Sell orders user have to place IOC Sell price <= current market price, otherwise it will get cancelled. Partial trade is possible in IOC orders.

User with IOC Order will be considered as "Taker" and cashback benefit will be considered according to it.

Post Order

- If the IOC order doesn’t match, it will not show in “Open Orders” , it will show in Order History as Cancelled.

- Once the IOC order matches and gets executed, it will show in “Trade History” as well as in “My Trades”.

- Execution of all orders are based on price-time-priority.

For e.g.: If trader "A" placed an IOC Buy Order in BTC/USDT @$20,200 with Total Value of $1,000, and there were best sellers of BTC/USDT were as of:

| Price | Amount | Total |

|---|---|---|

| $ 20,050.00 | 0.004988 | $ 100.00 |

| $ 20,110.00 | 0.009945 | $ 200.00 |

| $ 20,150.00 | 0.024814 | $ 500.00 |

| $ 20,200.00 | 0.019802 | $ 400.00 |

Here trade will settle up to $1,000 i.e., last trade will be of $200 @$20,200 and the amount will be $200/$20200=0.009901.

The total Amount of BTC bought will be 0.004988+0.009945+0.024814+0.009901= 0.049648.

Therefore, the average traded price will be $1000/0.049648=$20,141.92.

If the above order price was @$20,150 with Total Value of $1,000, then the total Amount of BTC bought will be 0.004988+0.009945+0.024814 = 0.039747 and the rest order will get cancelled, as the price didn’t match with available prices.

Limit Order

- Published Sep 01, 2023

Traders mostly use Limit orders where they want to trade only at their desired price with specific amount. A Limit Buy order is a Buy order where trader has provided limit price which is less than current market price or a Sell order where trader has provided limit price greater than current market price. Trades can happen only when the market price matches with defined price.

On the selection of Limit Order, option to put Price, Amount(quantity) and Total will be available. User can specify order price and any one of Amount or Total Value, the third value will autofill simultaneously.

To successfully place a Limit Order, one need to have the currency in their wallet, against which the other asset will execute. Let’s assume the Trading Pair is BTC/USDT. For Buy orders USDT need to be available to Buy BTC; and for Sell orders BTC need to be available to get USDT. The value of such order should be within the available limit.

If the order value is more than the available limit balance, it will show trader to add/deposit that asset with amount to fulfil the transaction.

If user have placed a limit order, the total order value will be reduced from the available balance even if same is yet to execute.

For Buy orders user have to place limit Buy price <= current market price, otherwise it will trade as market order; and for Sell orders user have to place limit Sell price >= current market price, otherwise it will trade as market order.

User with Limit Order will be considered as "Maker" and cashback benefit will be considered according to it.

Post Order

- If the limit order doesn’t match, it will show in “Open Orders”.

- Once the limit price matches with market price, it will get executed.

- Once the limit order gets executed completely, it will not show in open orders, it will show in “Trade History” as well as in “My Trades”.

- On partial execution, the executed portion will show in trades and the remaining will show in open orders.

- Execution of all orders are based on price-time-priority.

a) If trader "A" and trader "B" both have placed Buy order @100.00 and @100.20 respectively, and "A" have placed order earlier than "B", and the market price dropped from 101.00 to <=100.00, then first trade will be of trader "B" and then of trader "A".

b) If trader "A" and trader "B" both have placed Buy order @100.00 and "A" have placed order earlier than "B" and the market price dropped from 101.00 to <=100.00, then first trade will be of trader "A" and then of trader "B".

c) If trader "A" and trader "B" both have placed Sell order @101.00 and @101.20 respectively, and "B" have placed order earlier than "A", and the market price moved up from 100.00 to >=101.20, then first trade will be of trader "A" and then of trader "B".

d) If trader "A" and trader "B" both have placed Sell order @101.00 and "A" have placed order earlier than "B" and the market price moved up from 100.00 to >=101.00, then first trade will be of trader "A" and then of trader "B".

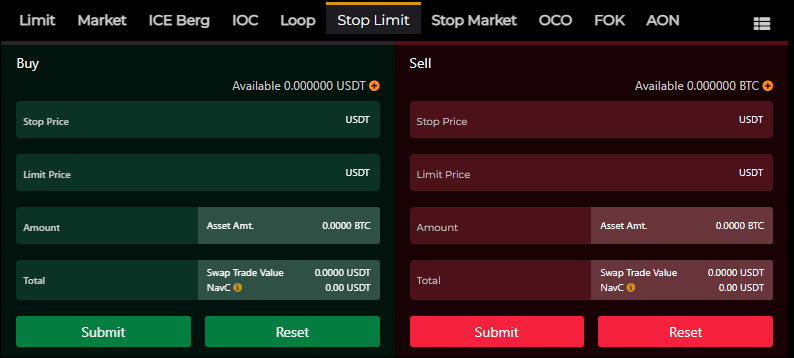

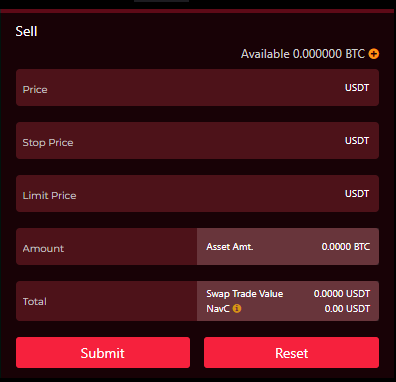

Stoploss Limit Order

- Published Sep 01, 2023

Traders mostly use Stop Limit orders where they want to restrict their loss from unfavorable and uncertain market movement and execute with triggering a defined price.

-

Registered users who usually have open position in an asset and don't want to lose invested capital from its unfavorable movement prefer Stop Limit Orders, i.e.

a) If trader have Buy position in BTC and want to exit from his position before unexpected downside movement in BTC, he can place Stop Sell Limit Order.

b) If trader have Sell position in BTC and want to exit from his position before unexpected upside movement in BTC, he can place Stop Buy Limit Order.

- With placing this order, once the trigger price hits with market, the limit order will throw in the market.

- It is not necessary to have open position before placing Stop Limit Order, User can use it to create position also.

- Orders will be placed in normal order book only when the market price (LTP) matches with the defined triggered price.

- Trades can happen only when the counter party price matches with the limit price given in the order.

- Trades can happen only when the counter party is available.

- Stop Price (Trigger Price):

- Limit Price: After hitting the Stop price (Trigger price) the limit order will get activated and placed in the market, to ensure the execution of it, the gap between Stop Price and Limit price should be enough.

- Any one of “Amount” or “Total”. On specifying Stop price, Limit Price and any one of Amount or Total Value, the third value will autofill simultaneously as per higher price calculation.

A Stop Limit order is an order where trader provides

a) For Buy Stop Order: Current Market Price < Stop Price <= Limit Price

b) For Sell Stop Order: Current Market Price > Stop Price >= Limit Price

To successfully place a Stop Limit Order, one need to have the currency in their wallet, against which the other asset will execute. Let’s assume the Trading Pair is BTC/USDT. For Buy orders USDT need to be available to Buy BTC; and for Sell orders BTC need to be available to get USDT. The value of such order should be within the available limit.

If the order value is more than the available limit balance, it will show trader to add/deposit that asset with amount to fulfil the transaction.

If user have placed a Stop Limit order, the total order value will be reduced from the available balance even if same is yet to execute.

User with Stop Limit Order will be considered either as "Maker" or as “Taker” as per the execution and cashback benefit will be considered according to it.

Post Order

- If the stop limit order doesn’t match, it will show in “Open Orders”.

- Stop limit order will remain open in secondary order book until it is getting triggered and will not be visible with normal orders in the order book.

- Once the stop price matches with market price, i.e., for Buy if LTP>=Stop Price it will get triggered or for Sell if LTP<=Stop Price it will get triggered.

- Once the stop price triggers, the limit order will be placed with limit price, and it will come in primary order book.

- Once the stop limit order gets executed completely, it will not show in open orders, it will show in “Trade History” as well as in “My Trades”.

- On partial execution, the executed portion will show in trades and remaining will show in open orders.

- Execution of all orders are based on price-time-priority.

a) For E.g.: User have placed a Sell BTC Stop Limit order:

- Current Market Price when placing orders: $22000

- Stop Price: $21950

- Limit Price: $21940.

b) After hitting Stop price $21950 BTC price moved down directly to $21930 and below that.

c) In this case Limit Sell order will remain open @ $21940 until BTC moved further up to it.

d) Execution of Stop Limit order is not guaranteed due to this reason.

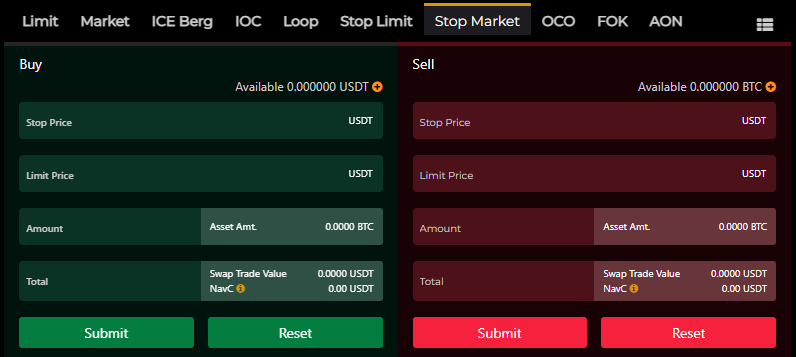

Stoploss Market Order

- Published Sep 04, 2023

Traders mostly use Stop Market orders where they want to restrict their loss from unfavorable and uncertain market movement and execute at market price on triggering a defined price.

-

Registered users who usually have open position in an asset and don't want to lose invested capital from its unfavorable movement prefer Stop Market Orders, i.e.

a) If trader have Buy position in BTC and want to exit from his position before unexpected downside movement in BTC, he can place Stop Market Sell Order.

b) If trader have Sell position in BTC and want to exit from his position before unexpected upside movement in BTC, he can place Stop Market Buy Order.

- With placing this order, once the trigger price hits with market, the market order will throw in the market.

- It is not necessary to have open position before placing Stop Market Order, User can use it to create position also.

- Orders will be placed in normal order book only when the market price (LTP) matches with the defined triggered price.

- Trades can happen only when the counter party is available.

- Stop Price (Trigger Price):

- Limit Price: This field will get disabled on the selection of Stop Market order. After hitting the Stop price (Trigger price) the market order will get activated and placed in the market.

- Any one of “Amount” or “Total”: On specifying Stop price, user need to fill either Amount or Total Value.

A Stop Market order is an order where trader provides

a) For Buy Stop Order: Stop Price > Current Market Price

b) For Sell Stop Order: Stop Price < Current Market Price

To successfully place a Stop Market Order, one need to have the currency in their wallet, against which the other asset will execute. Let’s assume the Trading Pair is BTC/USDT. For Buy orders USDT need to be available to Buy BTC; and for Sell orders BTC need to be available to get USDT. The amount/value of such order should be within the available limit.

If the order amount/value is more than the available limit balance, it will show trader to add/deposit that asset with amount to fulfil the transaction.

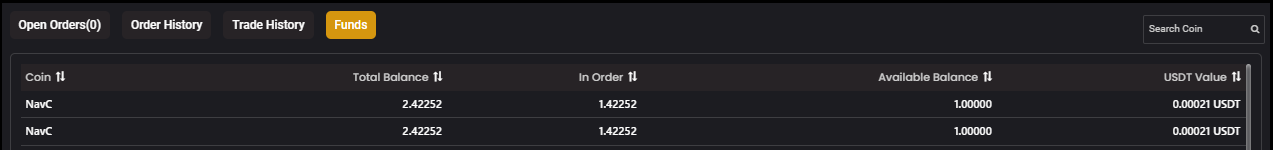

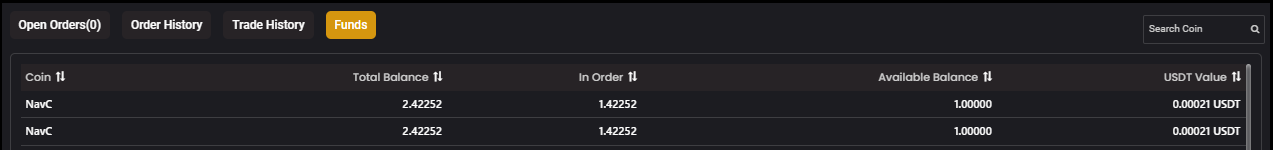

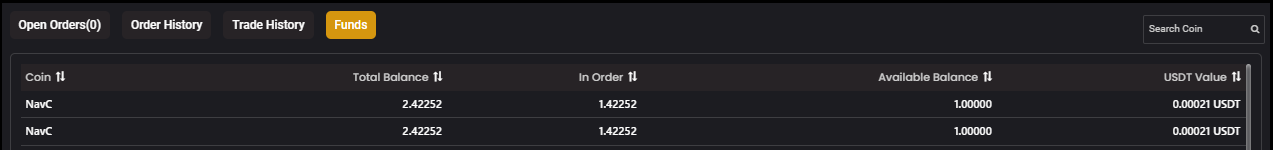

If user have placed a Stop Market order, the total order amount/value will be reduced from the available balance even if same is yet to execute and will show as “In Order”.

User with Stop Market Order will be considered either as “Taker” and cashback benefit will be considered according to it.

Post Order

- If the stop market order doesn’t match, it will show in “Open Orders”.

- Stop market order will remain open in secondary order book until it is getting triggered, and will not be visible with normal orders in the order book till then.

- Once the stop price matches with market price, i.e., for Buy if LTP>=Stop Price it will get triggered or for Sell if LTP<=Stop Price it will get triggered.

- Once the stop price triggers, the market order will be placed with DPR price, and it will normally get settle on immediate basis.

- Once the stop market order gets executed completely, it will not show in open orders, it will show in “Trade History” as well as in “My Trades”.

- On partial execution, the executed portion will show in trades and remaining will show in open orders with DPR price.

- Execution of all orders are based on price-time-priority.

a) For E.g.: User have placed a Sell BTC Stop Market order:

- Current Market Price when placing orders: $22000

- Stop Price: $21950

- Limit Price: Blank/Disabled.

b) After hitting Stop price $21950 BTC price moved down directly to $21930 and below that.

c) In this case Sell Market order will be placed with Lower DPR price.

d) Execution of Stop Market order is nearly guaranteed due to this reason.

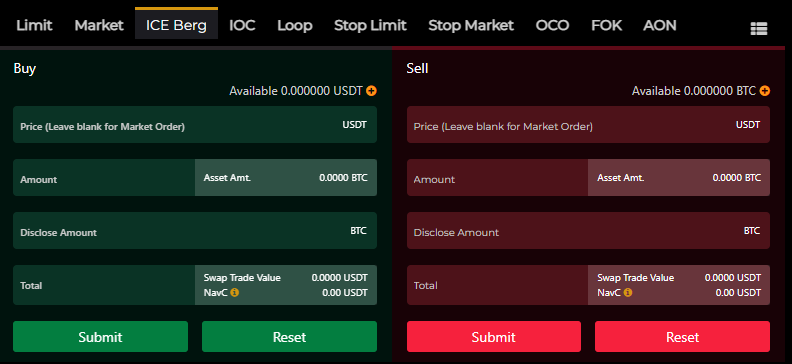

Iceberg Order

- Published Sep 22, 2023

Traders mostly use Iceberg orders where they want to disclose only a small part of total order size as iceberg. The purpose of it is to hide large order sizes from other market participants. An Iceberg order is a series of small orders from one order at a certain price.

On the selection of Iceberg Order, option to put Price, Amount(qty), Disclose Amount(qty) and Total will be available. Here user have to mention the disclose qty of that order which is subject to minimum 1/10th of the actual total quantity. Disclosed order qty/value must not be below the minimum qty/order value limit allowed in NavExM.

To successfully place an Iceberg Order, one need to have the currency in their wallet, against which the other asset will execute. Let’s assume the Trading Pair is BTC/USDT. For Buy orders, USDT need to be available to Buy BTC; and for Sell orders BTC need to be available to get USDT. The total order value, which is more than the disclose order value, should be within the available limit. If the total order value is more than the available limit balance, it will show trader to add/deposit that asset with the amount to fulfil the transaction.

If user have placed the iceberg order, the total order value will be reduced from the available balance even if same is yet to execute.

For Buy orders user have to place limit Buy price <= current market price, otherwise it will trade as market order; and for Sell orders user have to place limit Sell price >= current market price, otherwise it will trade as market order.

User with Limit Order will be considered as "Maker" and cashback benefit will be considered according to it.

Post Order

- If the iceberg order doesn’t match, it will show in “Open Orders”.

- Once the limit price matches with market price, it will get executed.

- Once the trade with one disclose amount completes, the next disclose order will appear instantly to match.

- Iceberg order always results into multiple transactions.

- Once all the disclosed orders get executed completely, it will not show in open orders, it will show in “Trade History” as well as in “My Trades”.

- On partial execution, the executed portion will show in trades and remaining will show in open orders.

- Execution of all orders are based on price-time-priority.

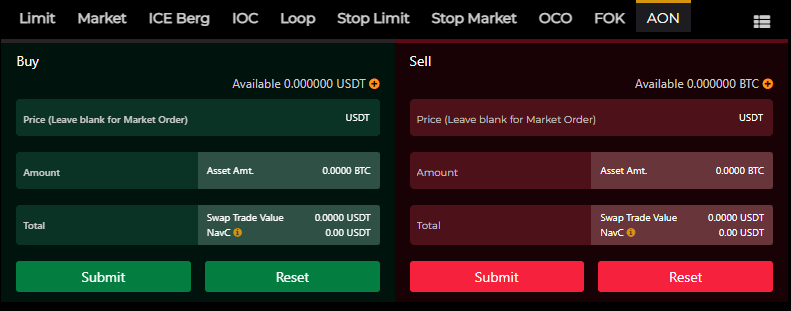

AON(All or None) Order

- Published Sep 07, 2023

Traders mostly use AON orders where they want to trade only when the desired price and specific amount both have matched with market. If any of them doesn’t match, it will remain open as pending.

On the selection of AON Order, option to put Price, Amount(quantity) and Total will be available. User can specify order price and any one of Amount or Total Value, the third value will autofill simultaneously.

To successfully place an AON Order, one need to have the currency in their wallet, against which the other asset will execute. Let’s assume the Trading Pair is BTC/USDT. For Buy orders USDT need to be available to Buy BTC; and for Sell orders BTC need to be available to get USDT. The value of such order should be within the available limit.

If the order value is more than the available limit balance, it will show trader to add/deposit that asset with amount to fulfil the transaction.

If user have placed an AON order, the total order value will be reduced from the available balance even if same is yet to execute.

For Buy orders usually user places limit Buy price <= current market price; and for Sell orders Sell price >= current market price, otherwise it will trade as market order.

User with Limit Order will be considered as "Maker" and cashback benefit will be considered according to it.

Post Order

- If the AON order doesn’t match with Price and Amount both, it will show in “Open Orders”.

- Once both matches with market, it will get executed.

- Once the AON order gets executed completely, it will not show in open orders, it will show in “Trade History” as well as in “My Trades”.

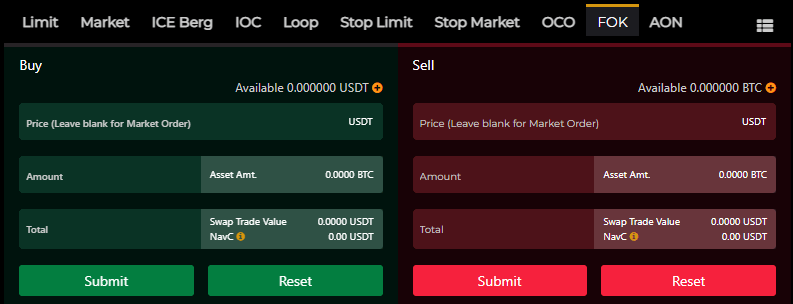

FOK(Fill or kill) Order

- Published Sep 26, 2023

Traders mostly use Fill Or Kill (FOK) orders where they want to trade only at their desired price and with specific amount both on immediate basis. If same is not matched with full amount (qty) on immediate basis, it will get cancelled, partial trade not possible here. Trades can happen only when the market price and the amount in the market with the price matches with the defined price and amount at the time when the order is placed.

On the selection of FOK Order, option to put Price, Amount(quantity) and Total will be available. User can specify order price and any one of Amount or Total Value, the third value will autofill simultaneously.

To successfully place a FOK Order, one need to have the currency in their wallet, against which the other asset will execute. Let’s assume the Trading Pair is BTC/USDT. For Buy orders USDT need to be available to Buy BTC; and for Sell orders BTC need to be available to get USDT. The value of such order should be within the available limit.

If the order value is more than the available limit balance, it will show trader to add/deposit that asset with amount to fulfil the transaction.

To trade with FOK order, for Buy orders user have to place Buy price >= current market price, otherwise it will get cancelled; and for Sell orders user have to place Sell price <= current market price, including the defined amount in that order, otherwise it will get cancelled on immediate basis. Partial trade is not possible in FOK orders.

User with FOK Order will be considered as "Taker" and cashback benefit will be considered according to it.

Post Order

- If any of the FOK condition doesn’t matches immediately, it will not show in “Open Orders” it will be cancelled and will be visible in Order History section.

- Once the FOK order gets executed, it will show in “Trade History” as well as in “My Trades” .

- Execution of all orders are based on price-time-priority.

a) For E.g.: User have placed a Sell BTC FOK order:

- Current Market Price when placing orders: $22000.

- Sell Order Price: $21990.

- Sell Order Amount (qty): 1.00

- If @ $21990 only 0.999 BTC are available to Buy in the Market while the order is placed, the order will get cancelled.

- If @ $21990 only 1 BTC or more are available to Buy in the Market while the order is placed, the order will get executed.

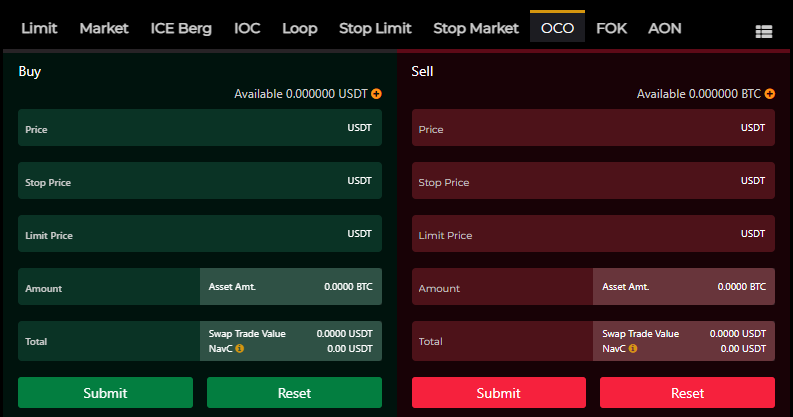

One Cancels the Other (OCO) Order

- Published Sep 10, 2023

Traders mostly use “One Cancels the Other” (OCO) orders where they want to take decision to Buy or decision to Sell the pair in two scenarios. In case of Buy, either to Buy at a limit price lower than market or if it breaks the resistance, then at a stop price greater than current price. It is a pair of conditional orders that if one order executes, then the other order is automatically canceled.

a. If trader wants to Buy BTC either it moves down to trader’s desired rate, or if it moves up to a price, after which it can increase sharply. If any of the event happens, it will Buy, and the other part will get cancelled.

b. If trader wants to Sell BTC either it moves up to trader’s desired rate, or if it moves down to a price, after which it can decrease sharply. If any of the event happens, it will Sell, and the other part will get cancelled.

An OCO order is an order where trader provides details of

- Price

- Stop Price

- Limit Price

- Amount/Total.

- Price: Desired rate at which user wants to trade.

- Stop Price (Trigger Price):

- Limit Price: After hitting the Stop price (Trigger price) the limit order will get activated and placed in the market, to ensure the execution of it, the gap between Stop Price and Limit price should be enough.

- Any one of “Amount” or “Total”. On specifying Price, Stop price, Limit Price and any one of Amount or Total Value, the fourth value will autofill simultaneously as per higher price calculation.

a) For Buy Order: Price < Current Market Price

b) For Sell Order: Price > Current Market Price

a) For Buy Stop Order: Current Market Price < Stop Price <= Limit Price

b) For Sell Stop Order: Current Market Price > Stop Price >= Limit Price

To successfully place an OCO Order, one need to have the currency in their wallet, against which the other asset will execute. Let’s assume the Trading Pair is BTC/USDT. For Buy orders USDT need to be available to Buy BTC; and for Sell orders BTC need to be available to get USDT. The value of such order should be within the available limit.

If the order value is more than the available limit balance, it will show trader to add/deposit that asset with amount to fulfil the transaction.

If user have placed an OCO order, the total order value will be reduced from the available balance even if same is yet to execute, and will show as “In Order”.

User with OCO Order will be considered either as "Maker" or as “Taker” as per the execution and cashback benefit will be considered according to it.

Post Order

- If the OCO order doesn’t match, it will show in “Open Orders”.

- With placing this order, two orders will show in Open orders until it’s execution. One (Limit Order) will be in primary order book and the other (Stop Order) will be in secondary order book.

- If Market price matches with Limit price, it will get executed and the Stop order will get cancelled.

- Once the market price matches with stop price, i.e., for Buy if LTP>=Stop Price it will get triggered or for Sell if LTP<=Stop Price it will get triggered.

- Once the stop price triggers, the limit order will be placed with limit price, and it will come in primary order book.

- Once the order gets executed completely, it will not show in open orders, it will show in “Trade History” as well as in “My Trades”.

- On partial execution, the executed portion will show in trades and remaining will show in open orders.

- Execution of all orders are based on price-time-priority.

a) For E.g.: User have placed a Sell BTC OCO order:

- Current Market Price when placing orders: $22000.

- Price: $23000.

- Stop Price: $21450.

- Limit Price: $21400.

b) Here user wants to Sell BTC @ $23000, when CMP is $22000. User has also identified that BTC has a support price of $21500. If that support price breaks, BTC will fall further sharply, and he will not be able to sell BTC at a good price.

c) To exploit this risk the Stop Price (trigger Price) is set as $21450 and Limit Price as $21400.

d) Now if market price hits $23000 first, it will execute, and the stop order will get cancelled.

e) If market price hits the trigger price $21450 first, limit Sell order @ $21400 will be placed and the normal order will get cancelled.

f) After hitting the Stop price $21450 BTC, if the next price moved down directly below $21400, in this case Limit Sell order will remain open @ $21400 until BTC moved further up to it.

g) Execution of Stop Limit order is not guaranteed due to this reason.

What Is Wallet?

- Published Sep 05, 2023

A cryptocurrency wallet is a digital wallet used to store digital codes that are necessary for sending and receiving cryptocurrency assets. There are several types of wallets available, including funding wallets, spot wallets, earn wallets, and margin wallets. In this article, we will discuss each of these wallets in detail.

Funding Wallet:

A funding wallet is a type of cryptocurrency wallet where you can store your fiat and cryptocurrency funds securely. This wallet is specifically designed to hold the funds that you will be using for trading or making transactions on an exchange platform. The funding wallet usually supports several crypto and fiat currencies, which makes it easier for you to deposit, withdraw, and trade different types of assets.

Once you have deposited funds into your funding wallet, you can use them to transfer or exchange to other wallets within the exchange platform. You can also withdraw your cryptocurrency to your bank account or other external wallets.

It is important to note that the funding wallet is usually the first wallet you use to deposit funds to your exchange account. Once you have funded your account, you can then transfer the funds to your other wallets or use them for trading.

Spot Wallet: A spot wallet is a type of cryptocurrency wallet where you can store your digital assets for a short-term period before executing any trades. When you open an account with a cryptocurrency exchange, you will typically receive a spot wallet automatically.

This wallet is used to hold your assets until you decide to sell or transfer them. You can also use the assets in your spot wallet to trade on the exchange platform. The balance in your spot wallet reflects the amount of cryptocurrency you currently hold that has not been used for any trades.

Earn Wallet: An earn wallet is a type of cryptocurrency wallet that is used to store rewards earned from various activities on an exchange platform. These rewards can be in the form of cashback, giveaways, airdrops, interest on staking, and more. The earn wallet is linked to the exchange platform, and the rewards are deposited directly into the wallet.

For example, if an exchange offers a cashback reward for trading a certain amount of cryptocurrency, the cashback reward will be deposited directly into the earn wallet. Similarly, if an exchange offers a staking reward for holding a certain cryptocurrency in your account, the staking rewards will be deposited directly into the earn wallet.

The earn wallet is a great way to earn passive income on your cryptocurrency assets. By keeping your assets in an earning wallet, you can earn rewards without actively trading or managing your investments. However, it is important to note that the rewards earned in the earn wallet may be subject to taxes and regulations, and it is important to understand the tax implications of earning rewards on your cryptocurrency investments.

Margin Wallet:

A margin wallet is a special type of cryptocurrency wallet that enables traders to buy or sell more cryptocurrency than the amount they currently have in their wallet. This is achieved by transferring funds from their funding wallet to their margin wallet and borrowing additional funds with a borrowing fee.

Leverage trading is the practice of using borrowed funds to increase the potential returns on an investment. By using a margin wallet, a trader can effectively magnify their trading positions and potentially earn higher profits than they would with their existing funds alone.

However, it's important to note that trading with leverage can also amplify potential losses, so it should be approached with caution and proper risk management strategies.

Once the leverage trading is complete, the trader can then move their funds back to their funding wallet. This allows them to return any borrowed funds and fees and ensure that their original investment remains intact.

Conclusion

In conclusion, understanding the different types of wallets and their functions is important when dealing with cryptocurrency assets. It is essential to choose the right wallet based on your requirements and goals.

Cashback

- Published Sep 07, 2023

At NavExM, we believe in rewarding our community members for trading on our exchange. That's why we offer a cashback program to all our traders.

NavExM rewards its Community Members with Cashback of up to 0.05% of the transaction value, which is distributed between the Takers and Makers, @ 60% and 40%, respectively.

If you trade on NavExM, you are eligible to receive a cashback benefit. The total cashback offered is distributed between Makers and Takers. A Maker is a trader who adds liquidity to the market, while a Taker is a trader who removes liquidity from the market.

Out of the total cashback offered, 60% is provided to Takers and 40% is provided to Makers.

For example:

if the total cashback offered is $20, Takers will receive $12 (60% of $20) and Makers will receive $8 (40% of $20).

To receive the cashback benefit, all you have to do is trade on NavExM. The more you trade, the more cashback you can earn!

Who is this cashback for?

NavExM offers a cashback program to incentivize All community members for trading on platform. This means that if you trade on NavExM, you can receive a certain percentage of the fees you pay in the form of cashback.

In this case, NavExM distributes the total cashback benefit between two types of traders: Makers and Takers.

A "maker" is a trader who adds liquidity to the market by placing limit orders on the order book, while a "taker" is a trader who removes liquidity from the market by taking orders off the order book.

Out of the total cashback offered, 60% is given to Takers and 40% to Makers.

For example:

So, if the total cashback offered is $20, $12 (60% of $20) will be given to Takers and $8 (40% of $20) will be given to Makers.

Therefore, if you are a Taker and you trade on NavExM, you will receive a cashback of $12 for the trading fees you pay on the exchange. If you are a Maker, you will receive a cashback of $8 for the trading fees you pay on the exchange.

Cashback Calculation

NavExM rewards its Community Members with Cashback of up to 0.05% of the transaction value, which is distributed between the Takers and Makers, @ 60% and 40%, respectively. Yes, Takers are given more.

Let’s understand it through an example:

If a transaction of $100,000 happens on NavExM, Takers can get a cashback of $30 NavC ($100,000 * 0.05% * 60%).

Cashback for Makers on the exchange will be $20 worth of NavC ($100,000 * 0.05% * 40%).

Cashback Limit & Condition

| Condition | Category | Cashback Benefit |

|---|---|---|

| Users holding < 500 NavC | Non-Community Members* | No Cashback, Cashback rewarded will be returned to the Pool Refund. |

| Users holding ≥ 500 NavC in Earn wallet | Community Members* | Cashback up to 0.05% of the trading value to be divided between Taker and Maker. |

| Staking ≥ 5,000 NavC | Standard Stakers* | Assured Cashback of 0.05% of the trading value for first 5 transactions each day |

| Staking ≥ 50,000 NavC | Premium Stakers* | Assured unlimited Cashback of 0.10% of the trading value for unlimited transactions |

* Limited Offer

Zero Swap Rate

- Published Sep 09, 2023

NavExM is a Next-Generation crypto exchange that is built with a trader-first approach. Our goal is to help all participants in the crypto market maximize their profit. We achieve this by offering the lowest swap rate in the market - 0%. That's right, Zero Swap rate!

At NavExM, we believe that traders should not have to pay hefty fees to trade in the crypto market. This is why we offer Zero Swap rate without any pre-requisite requirements. Whether you are a new trader or an experienced one, you can trade on our platform without worrying about swap rate.

Our platform is designed to be user-friendly and intuitive, making it easy for traders to buy and sell cryptocurrencies. We offer a wide range of trading pairs, including major cryptocurrencies like Bitcoin, Ethereum, and Litecoin, as well as newer altcoins.

In addition to our Zero Swap rate, we also offer a range of features that help traders make informed decisions. Our platform provides real-time market data, advanced trading tools, and charts to help traders analyze market trends and make the best trading decisions.

At NavExM, we are committed to providing a secure and reliable trading platform. We use the latest security measures to protect your assets and ensure that your personal information is safe.

Join NavExM today and start trading with Zero Swap rate. Experience a trader-first crypto exchange that puts your needs first.

Low Impact Cost

- Published Sep 11, 2023

Impact cost is an important consideration for traders as it refers to the cost incurred by a trader when they buy or sell an asset on an exchange. This cost is determined by the size of the trade and the liquidity of the exchange.

At NavExM, we understand the importance of reducing impact costs for our traders. That's why we offer Zero Swap Fees and cashback benefits for all trades on our exchange.

By trading on NavExM, you can significantly reduce your impact cost. Our Zero Swap Fees and cashback benefits mean that you earn more on every trade, each time, every time. This is because our cashback program incentivizes traders to trade more, increasing the liquidity of our exchange, which in turn lowers the impact cost.

The NavExM zero transaction cost and cashback benefit program is designed to increase liquidity on our exchange and make trading more profitable for our community members. So, join NavExM today and start trading with confidence, knowing that you are getting the best deal possible.

Investment Return Value (IRV)

- Published Sep 13, 2023

At NavExM, we believe in creating value for our community members. That's why we have introduced the concept of Investment Return Value (IRV) for our traders.

IRV is the value that traders can expect to receive in return for investing their time and resources on NavExM. With Zero Swap Fees and cashback benefits, the demand for our NavC token is expected to increase, leading to capital appreciation benefits for investors.

By trading on NavExM, you can earn NavC tokens as cashback rewards. These tokens are expected to increase in value by many folds as the trading volume on our exchange increases. This is because the more traders trade on our platform, the higher the demand for NavC tokens will be, which will drive up its price.

By offering Zero Swap Fees and cashback benefits, NavExM is creating a unique value proposition for traders. These benefits will attract more traders to our platform, leading to higher trading volumes, and consequently, higher demand for NavC tokens.

So, if you want to appreciate your capital, trade on NavExM, and earn NavC tokens as cashback rewards. The more you trade on our Next-Generation exchange, the more you stand to benefit from the Investment Return Value (IRV) of NavExM.

Positive Return on Trade

- Published Sep 14, 2023

At NavExM, we understand that trading can sometimes result in losses, which is why we offer a unique cashback program that can help make your trades positive, even if you sell your digital assets at a limited loss.

Let's take a look at an example to better understand how our cashback program works:

Suppose a trader buys Bitcoin for $21,000 and sells it for $20,999. The loss incurred in this trade is only $1.

However, with NavExM's cashback program, the trader can earn a cashback of $21, which is 0.10% of the sale price.

This means that the trader actually made a profit of $20, even though they sold the Bitcoin at a loss.

This is just one example of how NavExM's cashback program can help traders mitigate their losses and even turn them into profits. By offering a generous cashback program, we aim to incentivize traders to trade more frequently on our platform and increase liquidity on the exchange.

So, if you want to trade with confidence, knowing that even if you sell your digital assets at a limited loss, you can still earn a profit, then NavExM is the platform for you.

Get the capital appreciation benefit

- Published Sep 16, 2023

NavC Token is the primary token used on the NavExM exchange platform. This means that every trade made on NavExM, regardless of which cryptocurrency is being traded, will be processed using NavC Token [i.e., Each trade on the NavExM will be routed through NavC Token only].

As a result, the demand for NavC Token will increase, as traders will need to hold the token to use the exchange. This increased demand will result in a rise in the value of the NavC Token, known as capital appreciation.

The more trades made on NavExM, the higher the demand for NavC Token, and consequently, the higher the token's value appreciation. This is because more trades mean more users needing NavC Token to use the exchange, driving up the demand for the token.

In summary, the exclusive use of NavC Token on NavExM will drive up the demand for the token, leading to capital appreciation as the token captures the cryptocurrency pair trading values on the platform.

Make money in Arbitrage Trading

- Published Sep 19, 2023

Arbitrage trading is a popular strategy among traders who look for price discrepancies between different exchanges to make a profit. In the case of cryptocurrency, the price of a particular token can vary across different exchanges due to differences in supply and demand, trading volume, and other factors. Traders can exploit these price differences by buying low on one exchange and selling high on another.

At NavExM, we offer an excellent opportunity for traders to engage in arbitrage trading. Our Next-Generation cryptocurrency exchange provides cashback benefits on every transaction, allowing traders to find arbitrage opportunities despite the impact cost. With NavExM, traders can buy and sell crypto with confidence, knowing they can take advantage of any price differences between exchanges.

For example, let's say a trader buys bitcoin for $25,000 on one exchange and sells it for $24,999 on another exchange. The trader incurs a loss of $1 in this trade. However, with NavExM's cashback benefit of up to 0.10% of the transaction volume, the trader can earn back $25 (24,999*0.10%). As a result, the total profit made by the trader in this trade would be $24 ($25 - $1).

By trading on NavExM, the impact cost is reduced, and that creates an arbitrage opportunity for you. Our exchange is designed to offer traders the best possible trading experience, with advanced security features, low swap fees, and high liquidity. We also provide a range of educational resources and trading tools to help traders make informed decisions and succeed in the crypto market.

Join us at NavExM and take advantage of our innovative platform to explore new opportunities in the world of cryptocurrency trading.

Seamless Trading Experience

- Published Sep 20, 2023

NavExM crypto exchange is being built to provide the Next-Generation trading experience to crypto traders. Thus, NavExM considers it its responsibility to provide the best-in-class experience to our users.

Therefore, we are ready with a stunning UI. It is primarily focused on ease of use and smooth navigation. Further, the interface of the Next-Generation crypto exchange offers 3 types of trade page views. You can choose which suits you the best as per your requirements.

NavExM offers more than 10 types of spot orders on the Next-Generation crypto exchange that will help you maximize your profit.

A Secured Trading Environment

The NavExM team is committed to providing a safe and secure trading environment for its community members. The platform will utilize state-of-the-art security measures, cold storage for storing user funds, and regular security audits to ensure that your assets are protected at all times.

So, whether you're a seasoned trader looking for a new and exciting platform, or a crypto enthusiast eager to explore the world of digital asset trading, NavExM has something to offer

Augmented Liquidity Pool

- Published Sep 21, 2023

What is a Liquid Market?

Liquidity in the market means how easily you can sell off your cryptocurrency or how easily you can swap one crypto token for another. An extensive liquidity pool provides a sufficient number of traders ready to buy and sell their tokens. As the number of traders increases, the spread between the bid and ask orders becomes narrow.

This provides the most appropriate selling and buying price to the sellers and buyers, respectively. The more traders on the platform, the higher the liquidity will be.

How does Liquidity Impact the Trade Profit?

The lack of liquidity in the market increases Bid-Ask Spread. “Bid" means the price a trader is ready to pay, and "Ask” is the price a seller is willing to sell the asset at. The difference between the best bid and best ask is called Bid and Ask Spread.

Higher liquidity reduces the difference between Bid and Ask orders. This diminution creates a healthy market and provides the most adequate price for buyers and sellers. Liquidity is a major contributor to long-term profitability.

How does NavExM offer an Augmented Liquidity Pool?

NavExM offers a zero-trading platform and cashback benefits. Because of these privileges, traders will get attracted to trade on NavExM. On NavExM, your cashback can go up to 0.1% of the total transaction value based on your Staked NavC Tokens. The cashback benefits can significantly increase your overall trade profit.

All the dazzling benefits, and smooth interface, make NavExM the go-to place to trade. The rising number of orders will create a liquid market, further attracting traders to trade more. This cycle creates an Augmented Liquidity Pool on NavExM. This will provide an opportunity for even new crypto projects to find a liquid market and traders will be able to get the possible price for the same.

Unique Settlement Engine

- Published Oct 1, 2023

Understand the Unique Settlement Engine of NavExM: Cashback for Community Members.

NavExM, the innovative cryptocurrency exchange, boasts a one-of-a-kind trading engine design that sets it apart from other exchanges in the market. When you trade on NavExM, you'll notice that you receive only 99.98% of the asset you've just acquired. While this may seem like a minor reduction, it's all part of our system designed to reward and incentivize community participation.

Here's how it works:

NavC Token as the Core:

At the heart of NavExM's trading engine is NavC Token (NavC). Every trade on the exchange is routed through NavC, making it an integral part of the trading process.

The Trade Engine:

When you initiate a trade on NavExM, the trade engine first executes a trade with NavC. It temporarily holds 0.02% of the total NavC, and after holding this small portion, the rest is converted into the asset you desire. This conversion explains the slight reduction in the asset you receive.

Cashback for Community Members:

Here's where NavExM's community-centric approach truly shines. The remaining 0.02% of NavC, which wasn't used in your trade, isn't lost or wasted. Instead, it, along with rewards generated from capital appreciation due to the trade, is awarded to you as cashback.

Community Benefits:

It's important to highlight that this cashback is a unique feature available exclusively to NavExM community members. If you're an active member of the NavExM community, you'll enjoy the benefit of this cashback, which can add up significantly over time.

Non-Community Members:

If you're not a part of the NavExM community. Your 0.02% of NavC, as well as any associated rewards, are transferred to the community pool. This pool is designed to benefit the NavExM community as a whole. So, if you're not the community member, you are not eligible for this reward.

In essence, NavExM's trading engine is not only efficient but also community oriented. It encourages active participation by rewarding community members with cashback, while non-community members indirectly support the community's growth. This unique system sets NavExM apart as an exchange that not only facilitates cryptocurrency trading but also fosters a thriving, engaged community of users.

So, whether you're a seasoned trader or just getting started, NavExM has something special to offer for everyone. Join the community and experience the benefits of this exceptional exchange for yourself.

When placing a trade on NavExM, you may notice that you receive slightly less than your initially desired asset. This is due to the distinctive trading engine design of NavExM. Let's delve into how this process works:

- Each trade conducted on the NavExM platform is channeled through NavC, which is NavExM's native token.

- When you initiate a trade within a specific market, the trade engine first executes a trade involving NavC.

- Following the NavC trade, the system retains 0.02% of the total NavC obtained from this trade.